News Release

Arizona Metals Corp. Announces Closing of Bought Deal Public Offering

Toronto, Dec. 20, 2024 – Arizona Metals Corp. (TSX:AMC, OTCQX:AZMCF) (the “Company” or “Arizona Metals”) is pleased to announce that it has closed its previously announced bought deal public offering of 15,927,700 common shares (the "Common Shares") of the Company at a price of $1.70 per Common Share (the "Offering Price") for gross proceeds to the Company of $27,077,090 (the "Offering"), which includes the partial exercise of the over-allotment option by the underwriters to purchase 1,221,817 Common Shares. The Offering was conducted by a syndicate of underwriters co-led by Stifel Nicolaus Canada Inc. and Scotiabank, and included BMO Nesbitt Burns Inc., National Bank Financial Inc., Beacon Securities Limited and Clarus Securities Inc. (the "Underwriters").

In connection with the Offering, the Underwriters received a cash commission of 5.5% of the gross proceeds of the Offering, excluding gross proceeds from the sale of Common Shares on a president's list agreed upon by the Company and the Underwriters (the "President's List"), for which a commission of 2.75% of such gross proceeds was paid by the Company to the Underwriters.

The Company plans to use the net proceeds from the Offering to fund exploration expenditures at the Company's Kay Mine Project and Sugarloaf Peak Property, both in Arizona, as well as for working capital and general corporate purposes.

The Common Shares were offered in all provinces of Canada, except Quebec, pursuant to a short form prospectus dated December 18, 2024. The Common Shares were also sold to U.S. buyers on a private placement basis pursuant to an exemption from the registration requirements in Rule 144A of the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), and elsewhere in compliance with applicable securities laws.

Certain directors and officers of the Company (collectively, the "Insiders") acquired an aggregate of 88,236 Common Shares in the Offering. Participation by the Insiders in the Offering was considered a "related party transaction" pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company is exempt from the requirements to obtain a formal valuation or minority shareholder approval in connection with the Insiders' participation in the Offering pursuant to sections 5.5(a) and 5.7(1)(a) of MI 61-101 as neither the fair market value of any securities issued to, nor the consideration paid by, the Insiders exceeded 25% of the Company's market capitalization. The Company did not file a material change report 21 days prior to closing of the Offering as the Insiders' participation had not been confirmed at that time.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful. The securities being offered have not been, nor will they be, registered under the U.S. Securities Act and may not be offered or sold to, or for the account or benefit of, persons in the United States or "U.S. persons" (as such term is defined in Regulation S under the U.S. Securities Act) absent registration or an exemption from such registration requirements of the U.S. Securities Act and applicable states securities laws.

About Arizona Metals Corp

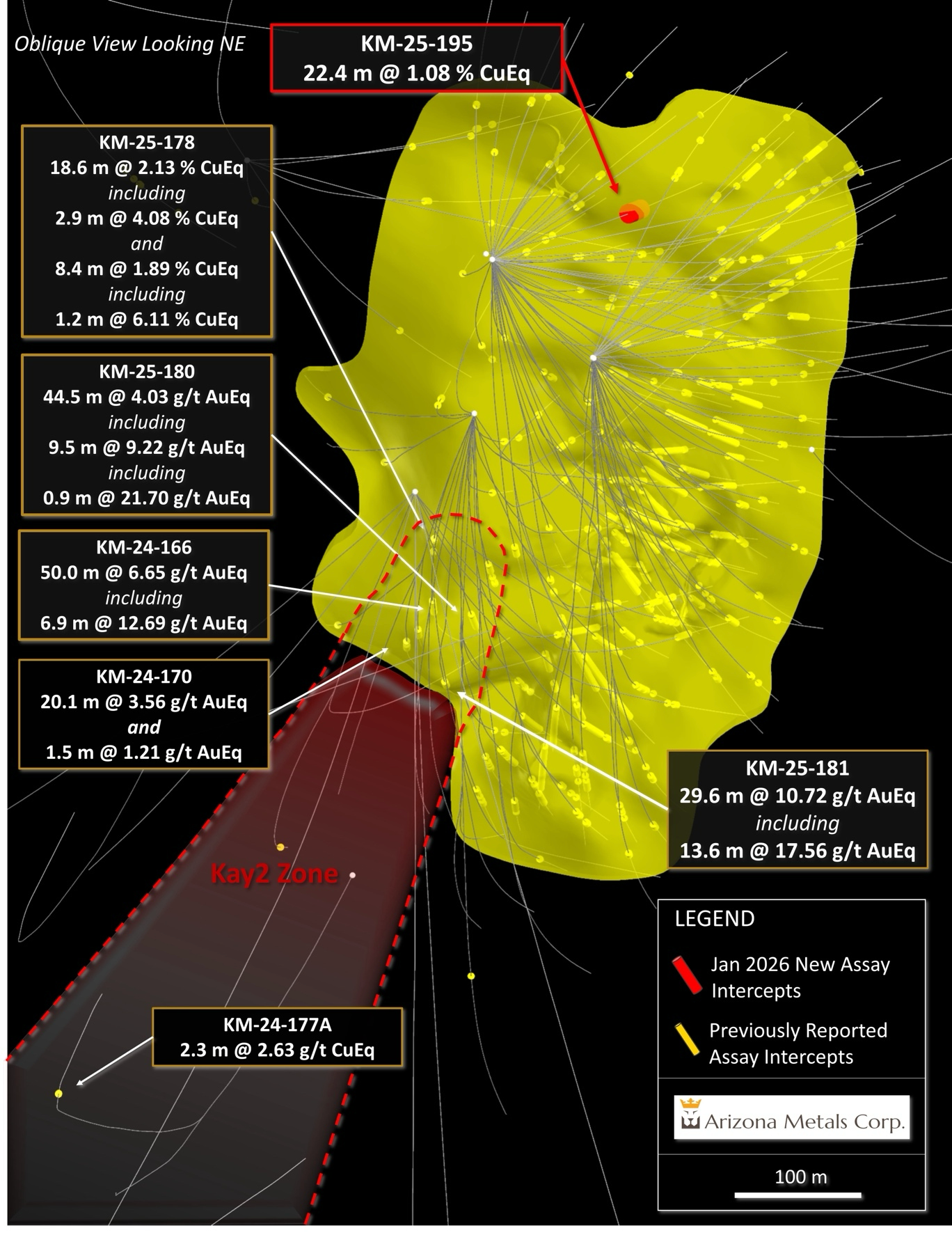

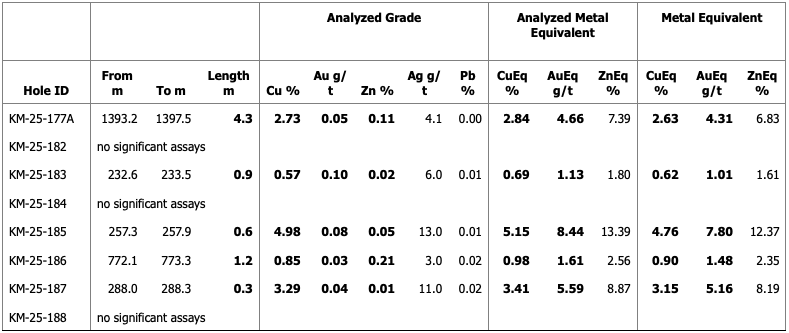

Arizona Metals Corp. owns 100% of the Kay Project in Yavapai County, which is located on 1,669 acres of patented and BLM mining claims and193 acres of private land that are not subject to any royalties. An historic estimate by Exxon Minerals in 1982 reported a "proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver." The historic estimate at the Kay Deposit was reported by Exxon Minerals in 1982. (Fellows, M.L., 1982, Kay Mine massive sulphide deposit: Internal report prepared for Exxon Minerals Company)

The Kay Mine historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Kay Mine is a steeply dipping VMS deposit that has been defined from a depth of 60 m to at least 900 m. It is open for expansion on strike and at depth.

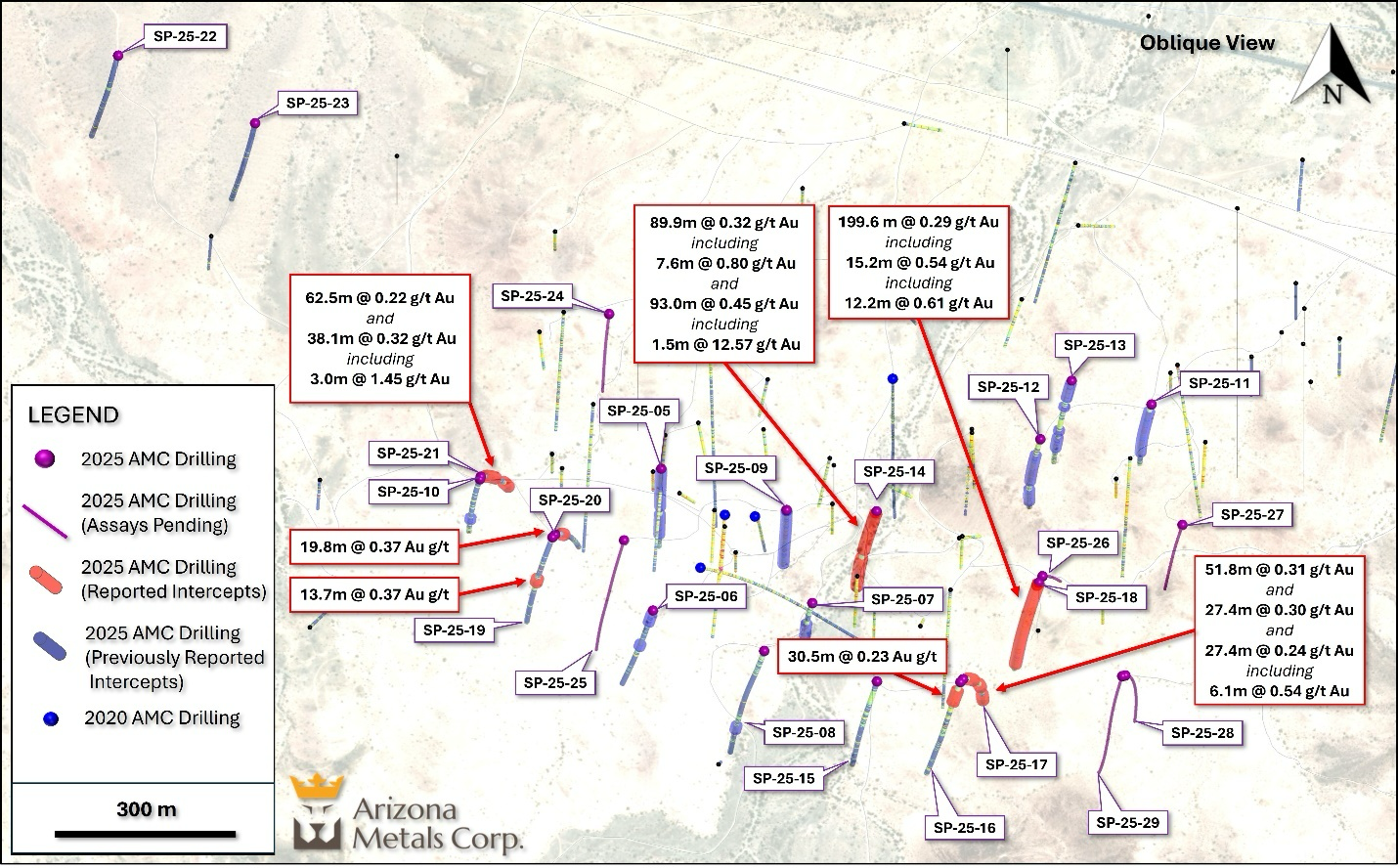

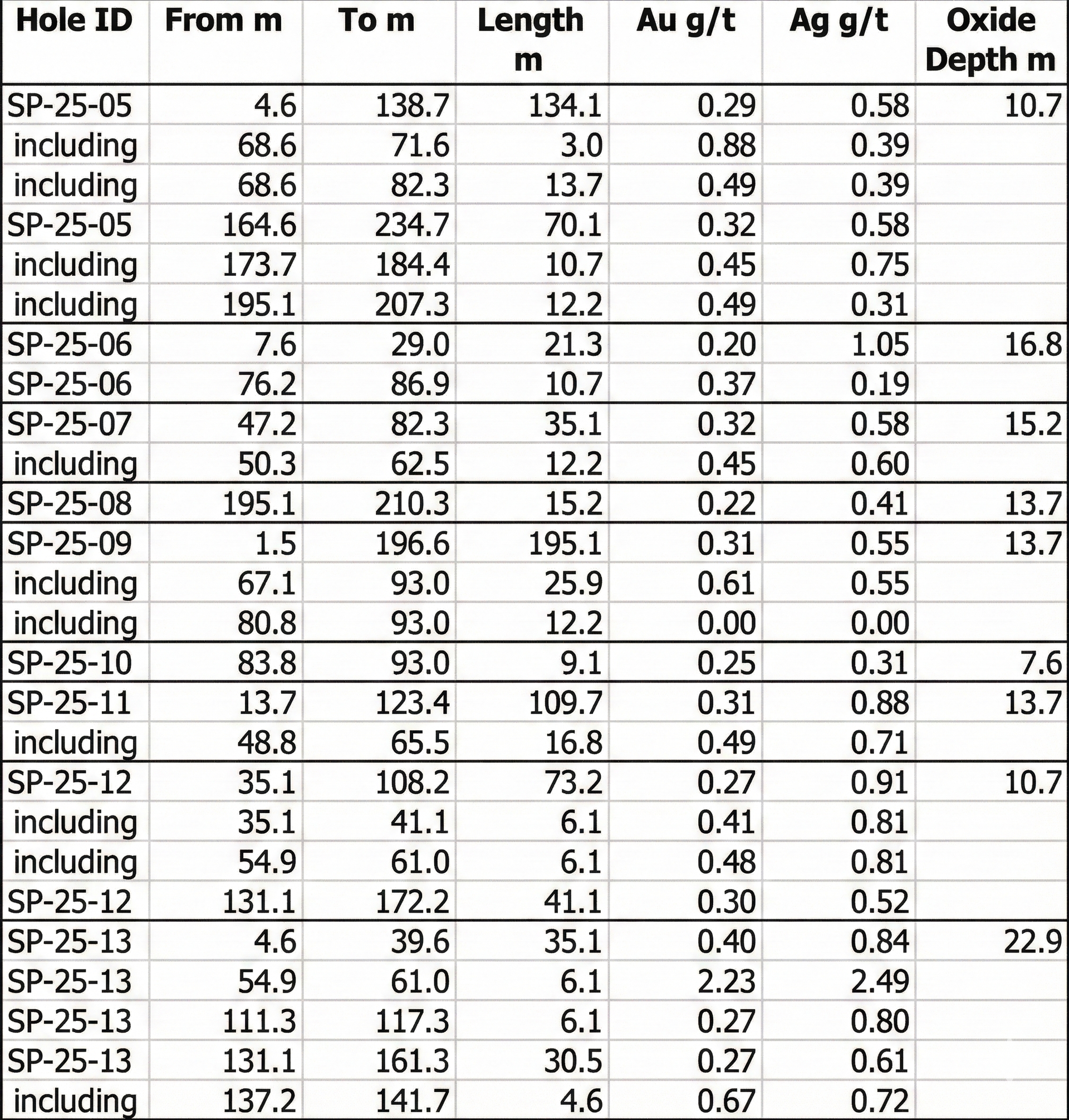

The Company also owns 100% of the Sugarloaf Peak Property, in La Paz County, which is located on 4,400 acres of BLM claims. Sugarloaf is a heap-leach, open-pit target and has a historic estimate of "100 million tons containing 1.5 million ounces gold" at a grade of 0.5 g/t (Dausinger, N.E., 1983, Phase 1 Drill Program and Evaluation of Gold-Silver Potential, Sugarloaf Peak Project, Quartzsite, Arizona: Report for Westworld Inc.)

The historic estimate at the Sugarloaf Peak Property was reported by Westworld Resources in 1983. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Qualified Person who reviewed and approved the technical disclosure in this release is David Smith, CPG, VP Exploration of the Company, and a qualified person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward looking statements. Forward-looking statements contained in this press release include, without limitation, statements regarding the completion of the Offering (including the receipt of required regulatory approvals) and the use of proceeds from the Offering. In making the forward-looking statements contained in this press release, the Company has made certain assumptions. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors may cause the actual results and future events to differ materially from those expressed or implied by such forward looking statements. Such factors include but are not limited to: the Company's ability to obtain future financing; delay or failure to receive required permits or regulatory approvals; and general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

THE TORONTO STOCK EXCHANGE HAS NEITHER REVIEWED NOR ACCEPTED RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Not for distribution to US newswire services or for release, publication, distribution, or dissemination directly or indirectly, in whole or in part, in or into the United States.

All monetary amounts are expressed in Canadian Dollars, unless otherwise indicated.

For further information, please contact:

Morgan Knowles

Vice President of Investor Relations

(647) 202-3904

mknowles@arizonametalscorp.com

or

Duncan Middlemiss

President and CEO

dmiddlemiss@arizonametalscorp.com

www.arizonametalscorp.com

https://x.com/ArizonaCorp

Recent News Releases