2024 News Releases

December 2, 2025

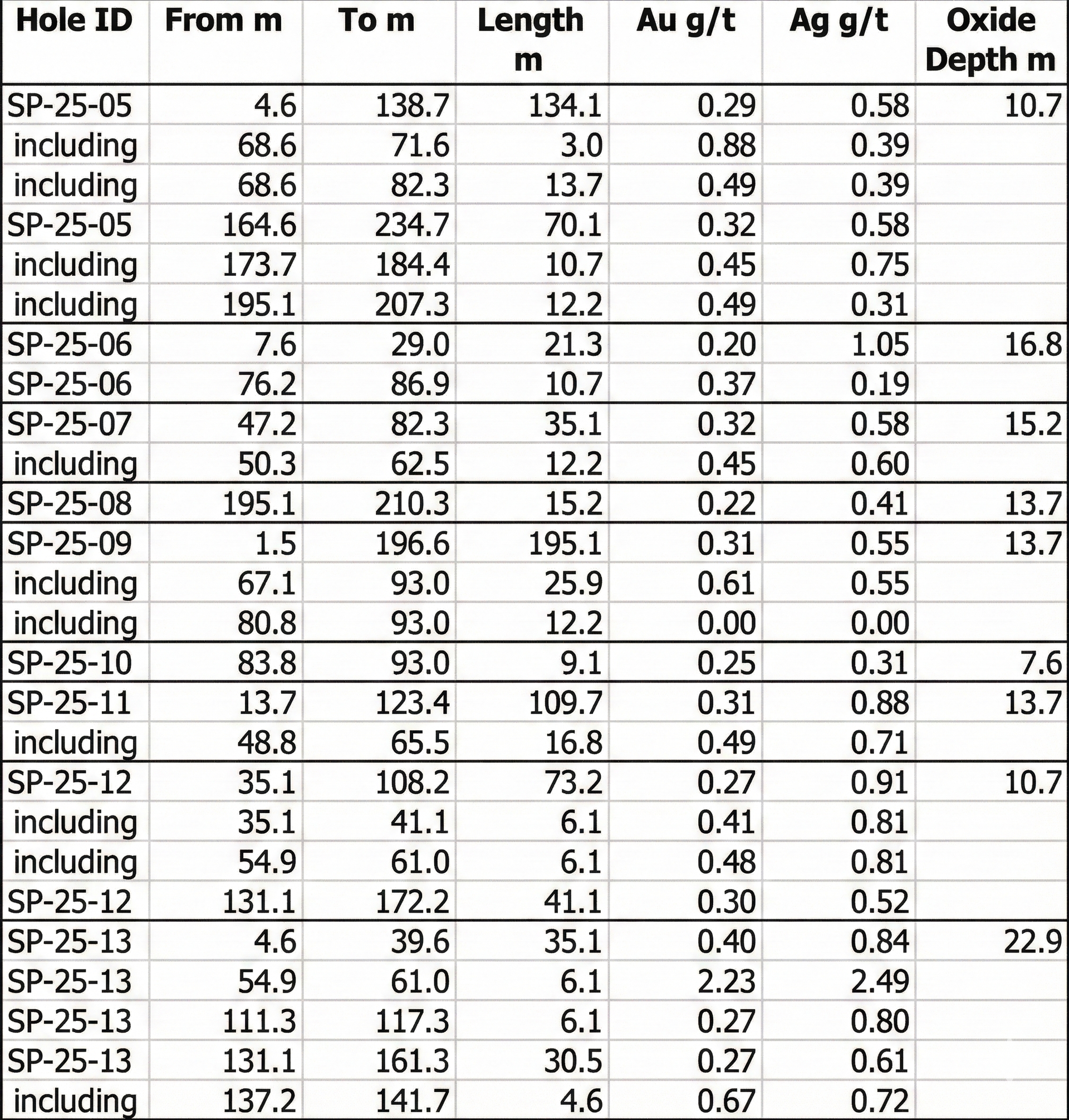

Toronto, December 2, 2025 – Arizona Metals Corp. (TSX:AMC, OTCQX:AZMCF) (the “ Company ” or “ Arizona Metals ”) is pleased to announce the first round of results from its 2025 reverse-circulation drill program on the Sugarloaf Peak project in Arizona. Highlights of the drilling include: SP-25-09: 195.1 m @ 0.31 g/t Au, including 25.9 m @ 0.61 g/t Au. This was an infill hole in the center of the deposit, demonstrating excellent continuity and mineralization from surface. SP-25-11: 109.7 m @ 0.31 g/t Au, including 16.8 m @ 0.49 g/t Au. This was an infill hole in a 300 x 300 m gap in the north-central part of the deposit; together with holes 12 and 13, this confirms good continuity of mineralization in this area, adding significant volume to the deposit. SP-25-05: 134.1 m @ 0.29 g/t Au and 70.1 m @ 0.32 g/t Au. This was a twin of historic hole WW-9 in the central portion of the deposit. SP-25-12: 73.2 m @ 0.27 g/t Au and 41.1 m @ 0.30 g/t Au. This was an infill hole in a 300 x 300 m gap in the north-central part of the deposit. Mineralization was intersected in all nine drill holes assayed to date in an area covering 900 m along the strike of mineralization and 800 m in width. These initial drill results are consistent with the drill program goals, as these results demonstrate mineralization in all infill holes and extend mineralization in all step-out holes received to date. In several drill holes, mineralization was also extended at a depth below previous drilling by 40-75 m. Assay results from the remaining 16 drill holes are pending. The total drilling to date on the project, in 2025, comprises 5,186 m drilled in 25 reverse-circulation drill holes. Duncan Middlemiss, President and CEO of Arizona Metals commented: “We are pleased to confirm the expansion potential at Sugarloaf Peak. This is a very large mineralized system that our drilling has expanded, not only laterally but within the deposit. In particular, our drilling confirmed excellent continuity of mineralization, a real benefit in a bulk-mining open-pit scenario. We intend to continue to explore Sugarloaf Peak and test its size within the deposit, at depth, and along strike.” Additional drill results are as follows: SP-25-06: 21.3 m @ 0.20 g/t Au and 10.7 m @ 0.37 g/t Au. This hole extends mineralization 95 m southwest of previous drilling, increasing the width of mineralization. SP-25-07: 35.1 m @ 0.32 g/t Au. Infill hole in a 260-m gap along the southwestern edge of the deposit, confirming good continuity of mineralization in this area. SP-25-08: 15.2 m @ 0.22 g/t Au. Stepout hole 110 m southwest of hole 7. Together with hole 7, this extends mineralization almost 200 m southwest in this portion of the deposit. SP-25-10: 9.1 m @ 0.25 g/t Au. Stepout hole to the 135 m to the west of previous drilling, warranting follow-up drilling in this area. SP-25-13: Four intervals, including 35.1 m @ 0.40 g/t Au and 30.5 m @ 0.27 g/t Au. Infill hole in a 300 x 300 m gap in the north-central part of the deposit. This hole returned the highest individual assay in this round of drilling so far, 6.64 g/t Au (56.4-57.9 m). Table 1. Results of drill program at the Sugarloaf Peak Project, Yavapai County, Arizona announced in this news release, including the depth of oxidized mineralization encountered in each hole.

December 20, 2024

Toronto, Dec. 20, 2024 – Arizona Metals Corp. (TSX:AMC, OTCQX:AZMCF) (the “ Company ” or “ Arizona Metals ”) is pleased to announce that it has closed its previously announced bought deal public offering of 15,927,700 common shares (the " Common Shares ") of the Company at a price of $1.70 per Common Share (the " Offering Price ") for gross proceeds to the Company of $27,077,090 (the " Offering "), which includes the partial exercise of the over-allotment option by the underwriters to purchase 1,221,817 Common Shares. The Offering was conducted by a syndicate of underwriters co-led by Stifel Nicolaus Canada Inc. and Scotiabank, and included BMO Nesbitt Burns Inc., National Bank Financial Inc., Beacon Securities Limited and Clarus Securities Inc. (the " Underwriters "). In connection with the Offering, the Underwriters received a cash commission of 5.5% of the gross proceeds of the Offering, excluding gross proceeds from the sale of Common Shares on a president's list agreed upon by the Company and the Underwriters (the " President's List "), for which a commission of 2.75% of such gross proceeds was paid by the Company to the Underwriters. The Company plans to use the net proceeds from the Offering to fund exploration expenditures at the Company's Kay Mine Project and Sugarloaf Peak Property, both in Arizona, as well as for working capital and general corporate purposes. The Common Shares were offered in all provinces of Canada, except Quebec, pursuant to a short form prospectus dated December 18, 2024. The Common Shares were also sold to U.S. buyers on a private placement basis pursuant to an exemption from the registration requirements in Rule 144A of the United States Securities Act of 1933, as amended (the " U.S. Securities Act "), and elsewhere in compliance with applicable securities laws. Certain directors and officers of the Company (collectively, the " Insiders ") acquired an aggregate of 88,236 Common Shares in the Offering. Participation by the Insiders in the Offering was considered a "related party transaction" pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (" MI 61-101 "). The Company is exempt from the requirements to obtain a formal valuation or minority shareholder approval in connection with the Insiders' participation in the Offering pursuant to sections 5.5(a) and 5.7(1)(a) of MI 61-101 as neither the fair market value of any securities issued to, nor the consideration paid by, the Insiders exceeded 25% of the Company's market capitalization. The Company did not file a material change report 21 days prior to closing of the Offering as the Insiders' participation had not been confirmed at that time. This press release shall not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful. The securities being offered have not been, nor will they be, registered under the U.S. Securities Act and may not be offered or sold to, or for the account or benefit of, persons in the United States or "U.S. persons" (as such term is defined in Regulation S under the U.S. Securities Act) absent registration or an exemption from such registration requirements of the U.S. Securities Act and applicable states securities laws.

December 19, 2024

Toronto, Dec. 19, 2024 – Arizona Metals Corp. (TSX:AMC, OTCQX:AZMCF) (the “ Company ” or “ Arizona Metals ”) announces that, further to its news release dated Dec. 2, 2024, it has filed a final short form prospectus dated December 18, 2024 (the " Final Prospectus ") with the securities commissions in each of the provinces of Canada, except Quebec pursuant to its $25,000,001 bought deal public offering of common shares (the " Common Shares ") at $1.70 per Common Share (the " Offering ") through a syndicate of underwriters co-led by Stifel Nicolaus Canada Inc. and Scotia Capital Inc. and including BMO Nesbitt Burns Inc., National Bank Financial Inc., Beacon Securities Limited and Clarus Securities Inc. (the " Underwriters "). The Company has granted the Underwriters an option (the " Over-Allotment Option ") to purchase an additional 2,205,883 Common Shares of the Company on the same terms exercisable at any time up to 30 days following the closing of the Offering, for market stabilization purposes and to cover over-allotments, if any. Today, the Underwriters exercised the Over-Allotment Option to purchase an additional 1,221,817 Common Shares, for an additional $2,077,089 in gross proceeds to the Company (bringing the total gross proceeds to $27,077,090). If the Over-Allotment Option is exercised in full, an additional $1,672,912 in gross proceeds will be raised pursuant to the Offering and the aggregate gross proceeds the Offering will be $28,750,002. The Offering will be conducted in each of the provinces of Canada, except Quebec and may be offered in the United States on a private placement basis pursuant to an exemption from the registration requirements in Rule 144A of the United States Securities Act of 1933 (the " 1933 Act "), as amended, and applicable state securities laws, and certain other jurisdictions outside of Canada and the United States. Closing of the Offering is expected to occur on or about December 20, 2024. The Toronto Stock Exchange has conditionally approved the Offering and the listing of the Common Shares to be issued pursuant to the Offering (including any exercise of the Over-Allotment Option), subject to customary conditions. Final Short Form Prospectus is Accessible through SEDAR+: Delivery of the Final Prospectus and any amendment thereto will be satisfied in accordance with the "access equals delivery" provisions of applicable securities legislation. The Final Prospectus is accessible on SEDAR+ at www.sedarplus.ca . An electronic or paper copy of the Final Prospectus and any amendment may be obtained, without charge, from Stifel Nicolaus Canada Inc., at 161 Bay St. Suite 3800, by telephone at 1.416.367.8600 or by e-mail at prospectuscanada@stifel.com , by providing the contact with an e-mail address or address, as applicable. Prospective investors should read the Final Prospectus in its entirety before making an investment decision. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful. The securities being offered have not been, nor will they be, registered under the 1933 Act, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act, as amended, and applicable state securities laws. Note Regarding 2024 Interim Financial Statements The Company wishes to confirm that its auditors were not engaged to perform a review of the interim consolidated financial statements (i) for the three-months ended March 30, 2024 and filed on May 15, 2024 (the " Q1 2024 FS "), (ii) for the three and six-months ended June 30, 2024 and filed on August 8, 2024 (the " Q2 2024 FS "), or (iii) for the three and nine-months ended September 30, 2024 and filed on November 14, 2024 (the " Original Q3 2024 FS ", and, collectively with the Q1 2024 FS and the Q2 2024 FS, the " 2024 Interim FS "). While the Company included a "notice to reader" in each of the 2024 Interim FS advising that the respective financial statements were prepared by and the responsibility of management, the Company inadvertently omitted from each of the 2024 Interim FS a statement confirming that its auditors had not been engaged to review the respective financial statements, as required in accordance with section 4.3(3) of NI 51-102 – Continuous Disclosure Obligations. The Original Q3 2024 FS have been amended and restated (the " Amended Q3 2024 FS "), and the auditors of the Company were engaged to review the Amended Q3 2024 FS. The Amended Q3 2024 FS have been filed on SEDAR+ and are incorporated by reference into the Final Prospectus. Readers are advised that the neither the Q1 2024 FS, the Q2 2024 FS, nor the Original Q3 2024 FS were reviewed by the auditors of the Company.