Investor Overview

Why Invest ?

Arizona Metals Corp. is a premier mineral exploration company focused on advancing two 100%-owned, high-potential projects in Arizona, USA—the Kay Mine Project in Yavapai County and the Sugarloaf Peak Gold Project in La Paz County. Both projects are situated in mining-friendly jurisdictions with excellent infrastructure, providing a strong foundation for exploration success. The Kay Mine Project hosts hosts a high-grade VMS deposit with excellent mineral resource grades, while Sugarloaf Peak is a large-scale, heap-leach gold target with a historic resource estimate of 1.5 million ounces of gold at 0.5 g/t Au. Although this historic estimate is not yet compliant with NI 43-101 standards, ongoing drilling and verification efforts present a significant opportunity for resource expansion. Arizona Metals is led by an experienced management team with a track record of success in mineral exploration, project development, and capital markets, positioning the company for growth and shareholder value creation.

Arizona Metals Corp. is advancing gold and base metal exploration in Arizona, a top-tier mining jurisdiction with a rich history of high-grade discoveries. With 100% ownership of the Kay Mine Project and Sugarloaf Peak Project, the company is actively expanding its high-grade VMS and bulk-tonnage gold resources through ongoing exploration and drilling.

Investment Highlights

Arizona Metals Corp. holds a 100% interest in both the Kay Mine Project and Sugarloaf Peak Project, two highly prospective assets located in mining-friendly Arizona, with excellent infrastructure and access to skilled labor.

Two High-Potential, 100%-Owned Projects

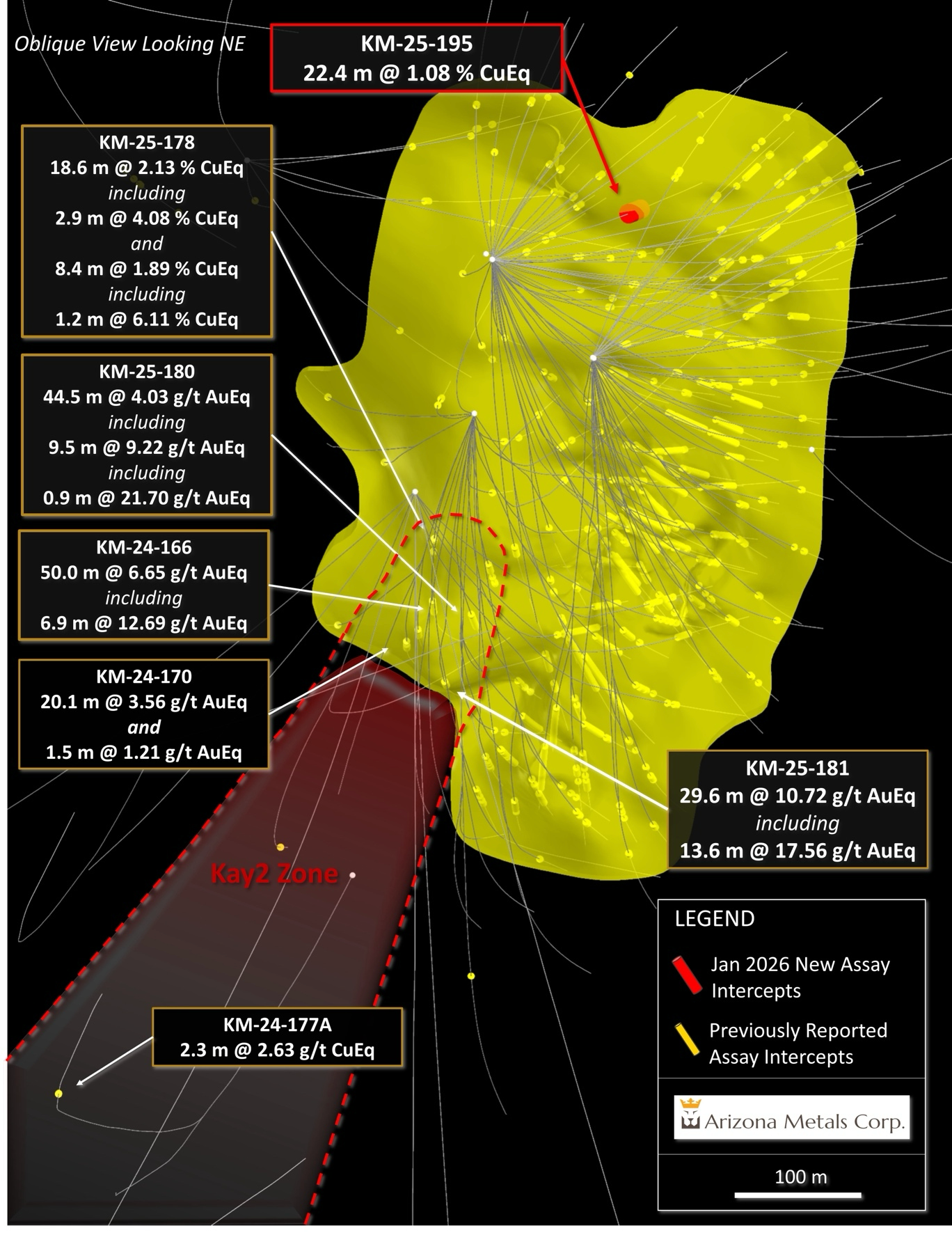

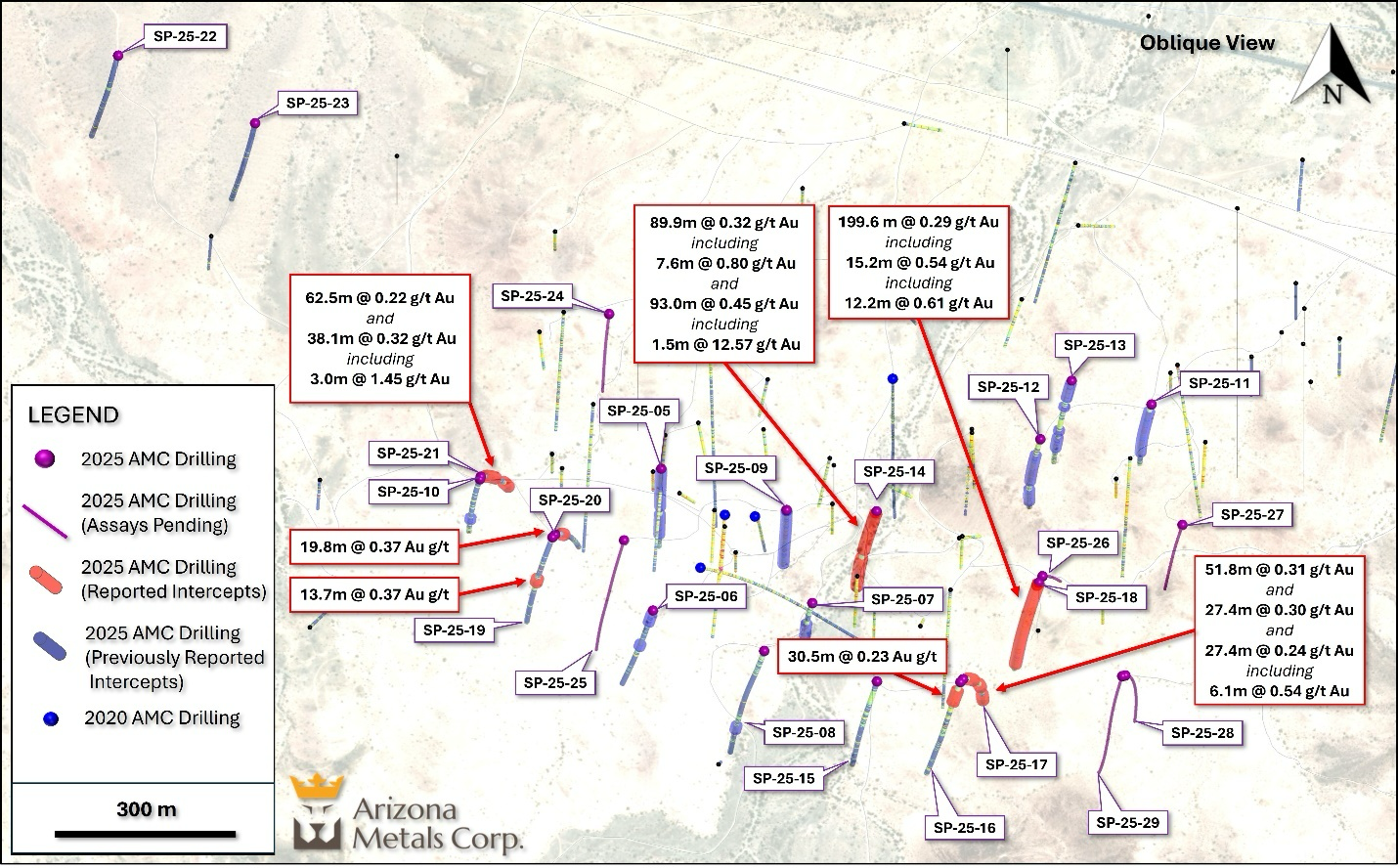

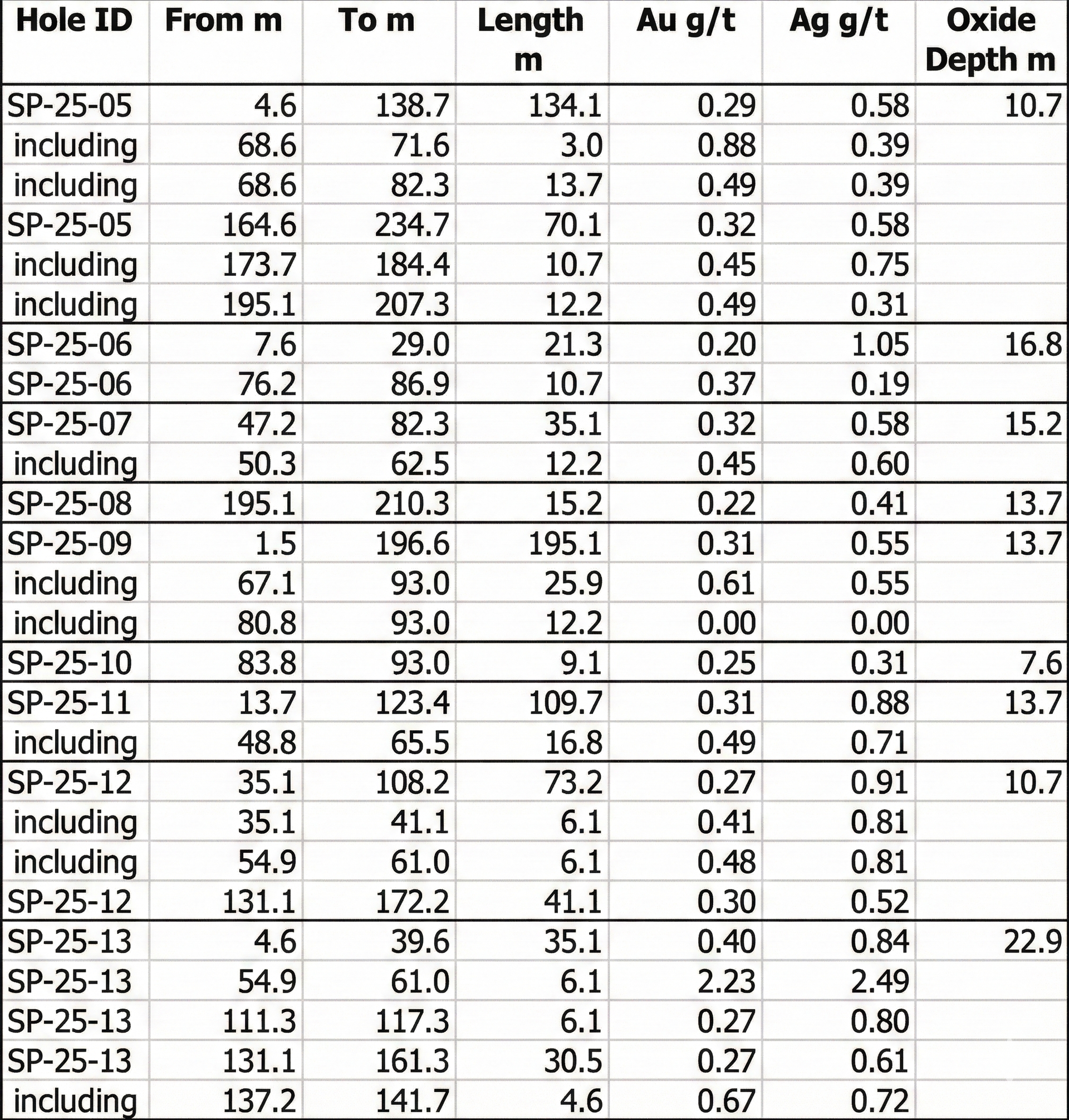

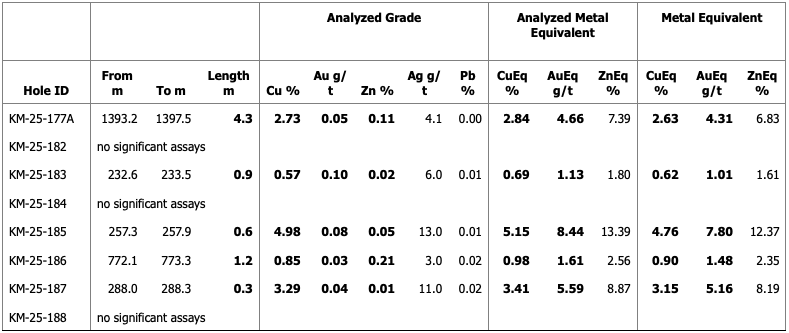

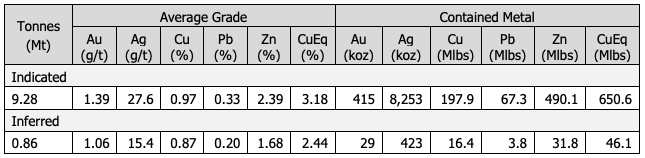

Arizona Metals Corp. has two projects with resources: Kay Mine, a high-grade VMS deposit (9.28 million tonnes @ 3.18% CuEq in the Indicated category), and Sugarloaf Peak, hosting a historic resource of 1.5 million ounces of oxide gold. Both projects remain open for expansion, with drilling targeting deeper and lateral extensions.

Significant Resource Growth Potential

The company has a solid cash position, no debt, and strong institutional and retail backing. Analyst coverage from multiple investment banks highlights Arizona Metals as a compelling exploration investment.

Strong Financial Position & Capital Markets Support

The management and technical team have extensive experience in mineral exploration, resource development, and capital markets, having successfully advanced projects from discovery to development in multiple jurisdictions worldwide.

Proven Leadership & Exploration Success

Download Our Corporate Presentation

Get an in-depth look at Arizona Metals Corp.’s corporate strategy, exploration expertise, and high-potential projects. Download our corporate presentation to learn more about the Kay Mine and Sugarloaf Peak Projects and the company’s path to unlocking significant resource growth. Join our mailing list to receive the latest company updates, press releases, and investor news directly to your inbox.

Capital Structure

As at March 3rd, 2025

| 136.7 M | 5.25 M | Nil | 141.95 M | $30.0 M | $27.07 M |

|---|---|---|---|---|---|

| Shares Outstanding | Options/RSU's | Warrants | Shares Fully Diluted | Cash (March 30, 2025) | Recent Financing @ $1.70 |

TSX: AMC

OTCQX: AZMCF

TSX: AMC

Analyst Coverage

Investment firms and equity analysts listed below provide research reports on Arizona Metals Corp.

Firm

Analyst

Phone

News and Updates

Get the latest news and updates from the Arizona Metals Corp. (TSX: AMC)

External Contact Information

Below, you'll find contact information for our transfer agent, corporate counsel and independent auditor.

Transfer Agent

TSX Trust Company

100 Adelaide St. West, Suite 301

Toronto, Ontario, M5H 4H1, Canada

+1 (416) 342-1091

Auditor

McGovern Hurley LLP

251 Consumers Road, Suite 800

Toronto, Ontario, M2J 4R3, Canada

+1 (416) 496-1234

Legal

WeirFoulds LLP

4100 – 66 Wellington Street West

Toronto, Ontario, M5K 1B7, Canada

+1 (416) 365-1110

Financials

Corporate Filings

FAQs

Find answers to common questions about Arizona Metals Corp.

What are Arizona Metals Corp.'s primary projects?

Arizona Metals Corp. owns 100% of two key projects in Arizona, USA:

- Kay Mine Project: A high-grade copper-gold-zinc-silver volcanogenic massive sulfide (VMS) deposit located in Yavapai County.

- Sugarloaf Peak Project: A bulk-tonnage oxide gold deposit situated in La Paz County.

What are the resource estimates for these projects?

- Kay Mine Project: 2025 MRE, 9.2M tonnes @ 3.2% CuEq Indicated + 0.9M tonnes @ 2.4% CuEq Inferred

- Sugarloaf Peak Project: A 1983 estimate by Westworld Resources indicated 100 million tons containing 1.5 million ounces of gold at a grade of 0.5 g/t.

Please note the Sugarloaf Peak estimate is a historic estimate and not compliant with current NI 43-101 standards. Significant data compilation, re-drilling, and data verification are required by a Qualified Person before these can be classified as current mineral resources.

Where can I find Arizona Metals Corp.'s financial statements and corporate filings?

FinancialsFinancial statements and corporate filings are available on the company's official website under the "Investors" section.

How can I stay informed about Arizona Metals Corp.'s developments?

Join Mailing ListYou can subscribe to the company's mailing list through their website to receive the latest news, updates, and press releases.

Does Arizona Metals Corp. have a dedicated team for permitting and social license matters?

Yes, Arizona Metals currently works with WestLand Resources and Dorsey & Whitney on the Kay Project permitting process.

Additionally, since January 2022, the company has collaborated with Global External Relations to address community, government, and regulatory relations.

What is the permitting process for the Kay Mine Project?

The project is subject to state-administered permitting programs, including ADEQ Aquifer Protection Permitting and ASMI Reclamation requirements, which have licensing timeframes that help prevent unnecessary permitting delays.

Some facilities may be subject to federal permitting, which is managed by the Bureau of Land Management.

What is the significance of the Kay Mine Project being located on private land?

The Kay Mine's location on private land means it does not require a complex review process under the National Environmental Policy Act (NEPA). However, it is still subject to Arizona Department of Environmental Quality (ADEQ) and Arizona State Mine Inspector (ASMI) permitting requirements.

Are there any cultural or environmental concerns associated with the Kay Mine Project?

Early-stage archaeological and cultural surveys have not identified any tribal cultural sites. Additionally, detailed surveys have not found endangered species or critical habitats on the property. Routine surveys will continue as the project advances.

How does Arizona Metals Corp. address local community concerns, especially regarding water supply?

The company is closely tracking water supply trends. The Kay Project operates independently from the town's water supply wells, and efforts are made to ensure that operations do not adversely impact local water resources.

How can investors contact Arizona Metals Corp.?

Investors and the community can reach out through the contact form on the company's website or by contact us at:

Morgan Knowles

Vice President, Investor Relations

647.202.3904

Mknowles@arizonametalscorp.com

Kay Mine Road Work and Drilling Safety Contact:

Black Canyon Community Hotline:

623.252.2291